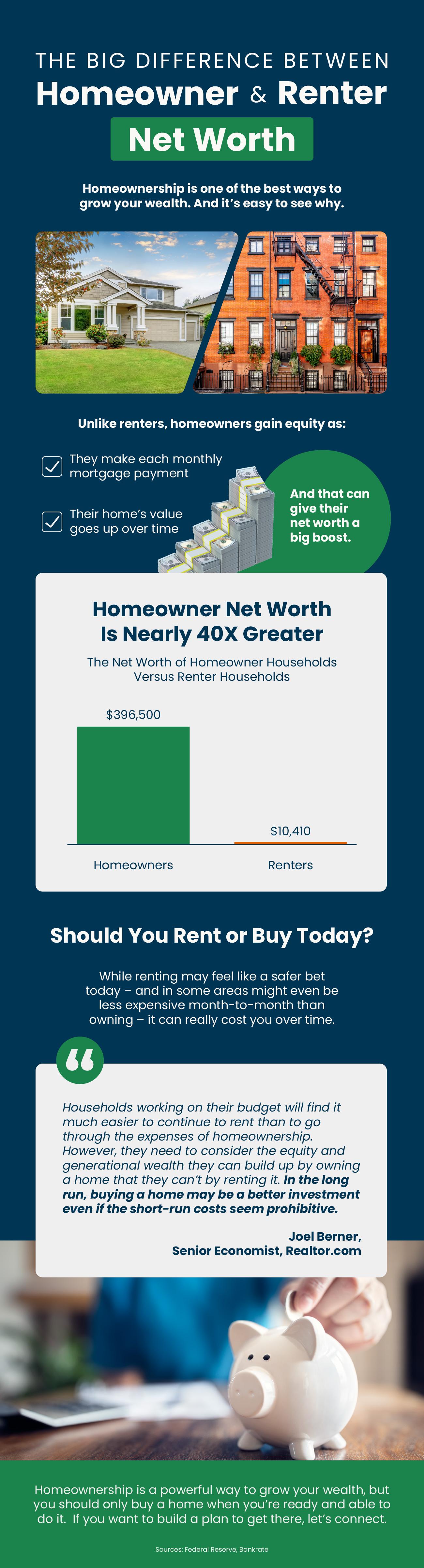

The Big Difference Between a Homeowner’s and a Renter’s Net Worth

Some Highlights

- Homeownership is one of the best ways to build wealth in our country and it’s easy to see why.

- As you pay down your mortgage and as home values rise over time, you gain equity – and that helps grow your net worth. That’s why a homeowner’s net worth is nearly 40X greater than a renters.

- But you should only buy a home when you’re ready and able to do it. If you want to build a plan to get there, connect with a local agent.

Categories

- All Blogs 617

- Buying Myths 6

- Down Payments 3

- Equity 1

- First Time Homebuyers 34

- Florida Real Estate 24

- For Buyers 51

- For Sellers 42

- Foreclosures 1

- Homeownership 16

- Housing Market Updates 27

- Infographics 6

- Interest Rates 6

- local market updates 4

- Millennials 2

- Mortgage 2

- Mortgage News 2

- Mortgage Rates 2

- Move Up Buyers 4

- Move-Up Buyers 7

- New Construction 1

- Pricing 10

- secondary homes 11

- Selling Myths 3

- Vacation Homes 21

Recent Posts

7 Hidden Costs of Owning a Beach House and How to Prepare for Them

What Mortgage Delinquencies Tell Us About the Future of Foreclosures

Downtown Sarasota Florida: Where Every Street Tells a Story

Thinking About Renting Your House Instead of Selling? Read This First.

Venice Florida Dog Parks and Trails: A Complete Local Guide

What Everyone’s Getting Wrong About the Rise in New Home Inventory

History Shows the Housing Market Always Recovers

North Port Florida: Is This the State’s Fastest Growing Community?

Should You Still Expect a Bidding War?

Are Short Term Rentals in Treasure Island Florida Worth It?