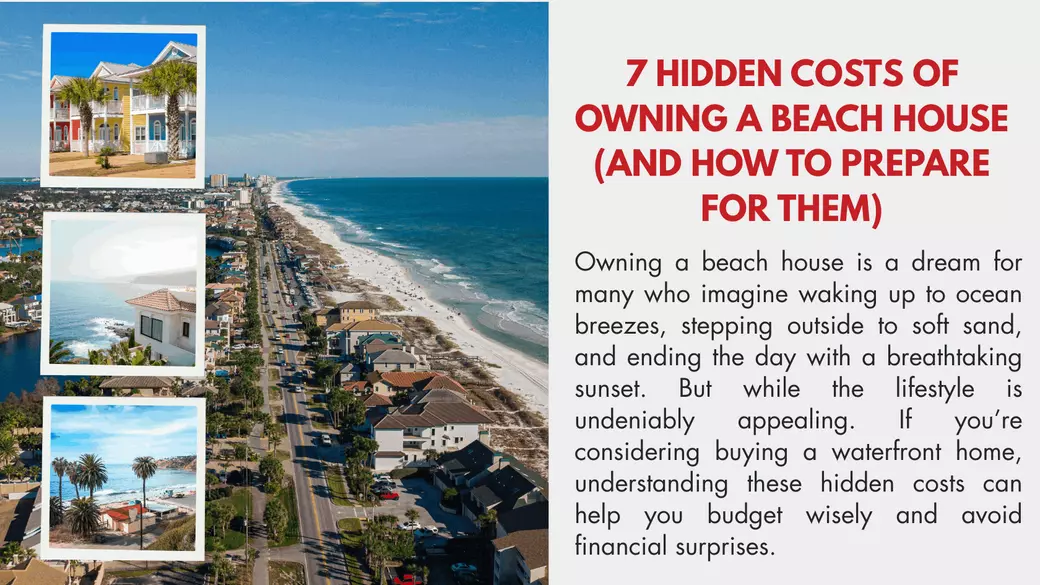

7 Hidden Costs of Owning a Beach House and How to Prepare for Them

Owning a beach house is a dream for many buyers. Waking up to the sound of waves, enjoying morning walks on the sand, and ending the day with coastal sunsets sounds like paradise. But along with that dream lifestyle come financial realities many buyers overlook.

Whether you're purchasing a vacation home or a waterfront investment property, understanding these often-hidden costs can help you plan wisely and avoid financial surprises. Here are seven key expenses you should be aware of before buying a beach house.

- Coastal Property Insurance

Beachfront properties are more exposed to natural elements, making insurance more complex and expensive.

What You May Need

Standard homeowners insurance

Flood insurance (required in FEMA flood zones)

Windstorm insurance (in high-risk areas)

Tip: Work with an insurance broker who specializes in coastal properties to ensure full coverage at the best available rate. Annual premiums can run high depending on the location and elevation of the home.

- Salt Air and Corrosion

Salt air can be damaging to almost every surface of your beach home. It leads to quicker deterioration of paint, metals, electronics, and HVAC systems.

Maintenance to Expect

Frequent exterior repainting and sealing

Replacement of corroded hardware and fixtures

Annual inspections and servicing of appliances and AC units

Tip: Use marine-grade materials and stainless steel hardware when building or remodeling to reduce future maintenance.

- Higher Utility Bills

Cooling a beach house during Florida’s hot and humid summers can drive up your utility costs significantly. Many homes also require dehumidifiers to prevent mold.

Common Utility Considerations

Higher electricity usage during warmer months

Use of dehumidifiers and air purifiers

Smart thermostats and insulation upgrades

Tip: Invest in energy-efficient systems and window treatments that help regulate temperature year-round.

- Coastal Maintenance and Repairs

Beachfront homes face wear and tear that inland homes don't. The combination of salt, wind, sun, and sand creates unique maintenance challenges.

Issues You May Encounter

Sand build-up in doors and sliding tracks

Faster roof deterioration from salt air

Seawall or dock inspections and repairs

Tip: Plan to spend a higher percentage of your home’s value on annual maintenance compared to a traditional home. Regular upkeep prevents larger repair costs down the road.

- HOA or Community Fees

Many coastal properties are part of gated or private communities that charge Homeowners Association fees for amenities and upkeep.

These Fees May Cover

Beach access and maintenance

Pool, clubhouse, and landscaping services

Security or gate operations

Tip: Review the HOA’s financial statements and regulations before purchasing. These fees can vary widely based on the community and location.

- Vacation Rental Management Costs

Many beach house owners use short-term rentals to offset costs. While it can be lucrative, it also adds expenses.

Costs to Expect

Property management fees typically between 20 and 30 percent of rental income

Professional cleaning services between guest stays

Wear and tear from frequent use

Tip: If you plan to rent, choose a property in a rental-friendly zone and partner with an experienced vacation rental manager.

- Property Value Fluctuations

While beachfront homes often appreciate in value over time, coastal real estate markets can be volatile based on storm history, insurance changes, and zoning adjustments.

Factors That Affect Resale Value

FEMA flood map updates

Storm or hurricane damage history

Market shifts in vacation home demand

Tip: Work with a local real estate expert who understands the area's trends and long-term stability before you buy.

Final Take: Plan Smart for Your Beachfront Lifestyle

Owning a beach house is a rewarding investment and a lifestyle upgrade. But without careful planning, hidden costs can impact your financial return and peace of mind. The key is to go in with eyes wide open, understand all the expenses, and work with experienced professionals who can guide you through every step.

Thinking About Buying a Beach House in Florida?

At Hunt Brothers Realty, we specialize in coastal properties. From evaluating flood zones and insurance needs to identifying top-performing vacation rental opportunities, our team helps you make informed decisions that protect your investment and elevate your lifestyle.

Contact Hunt Brothers Realty

Hunt Brothers Realty46 N Washington Blvd Ste #3

Sarasota, Florida 34236

Phone: (941) 388-7017

Email: info@huntbrothersrealty.com

Categories

- All Blogs 650

- Buying Myths 6

- Down Payments 4

- Equity 1

- First Time Homebuyers 46

- Florida Real Estate 37

- For Buyers 64

- For Sellers 54

- Foreclosures 1

- Homeownership 24

- Housing Market Updates 27

- Infographics 6

- Interest Rates 6

- local market updates 4

- Millennials 2

- Mortgage 2

- Mortgage News 2

- Mortgage Rates 2

- Move Up Buyers 4

- Move-Up Buyers 7

- New Construction 1

- Pricing 10

- secondary homes 14

- Selling Myths 3

- Vacation Homes 34

Recent Posts