What You Really Need To Know About Down Payments

Some Highlights

- There’s a misconception going around that you have to put 20% of the purchase price down when you buy a home. But the truth is, many people don’t put down that much unless they’re trying to make their offer more competitive.

- And if you want to give your savings a boost, look into down payment assistance. Most first-time buyers qualify and the typical benefit is $17,000.

- To learn more about loan options or down payment assistance programs, connect with a trusted lender and check out downpaymentresource.com.

Categories

- All Blogs 625

- Buying Myths 6

- Down Payments 3

- Equity 1

- First Time Homebuyers 36

- Florida Real Estate 27

- For Buyers 54

- For Sellers 44

- Foreclosures 1

- Homeownership 19

- Housing Market Updates 27

- Infographics 6

- Interest Rates 6

- local market updates 4

- Millennials 2

- Mortgage 2

- Mortgage News 2

- Mortgage Rates 2

- Move Up Buyers 4

- Move-Up Buyers 7

- New Construction 1

- Pricing 10

- secondary homes 11

- Selling Myths 3

- Vacation Homes 24

Recent Posts

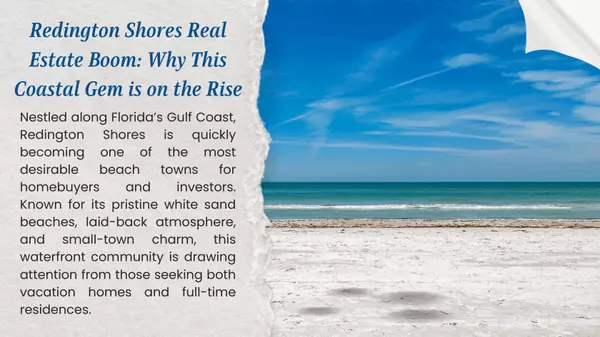

Redington Shores Real Estate Boom: Why This Coastal Gem Is on the Rise

What a Fed Rate Cut Could Mean for Mortgage Rates

Buying a Condo vs. Single-Family Home in Lakewood Ranch: Which is Right for You?

Patience Won’t Sell Your House. Pricing Will.

Mortgage Rates Just Saw Their Biggest Drop in a Year

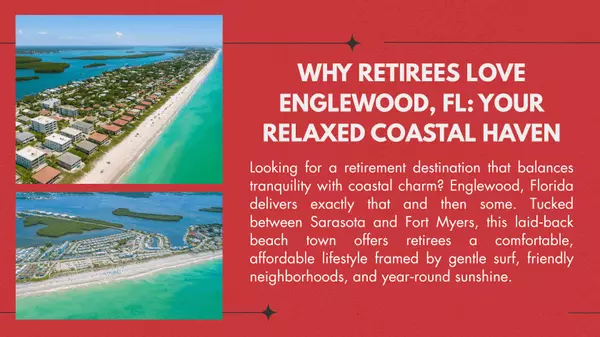

Why Retirees Love Englewood, FL: Your Relaxed Coastal Haven

Why 50% of Homes Are Selling for Under Asking and How To Avoid It

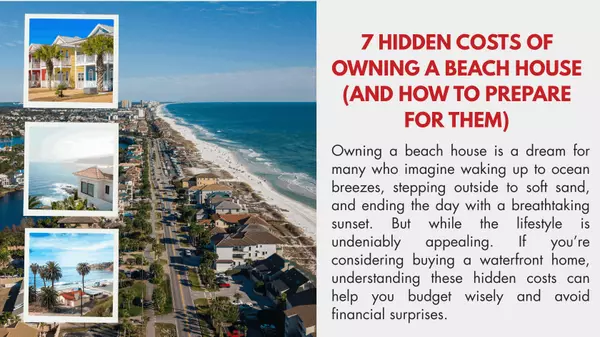

7 Hidden Costs of Owning a Beach House and How to Prepare for Them

Builder Incentives Reach 5-Year High

What Mortgage Delinquencies Tell Us About the Future of Foreclosures