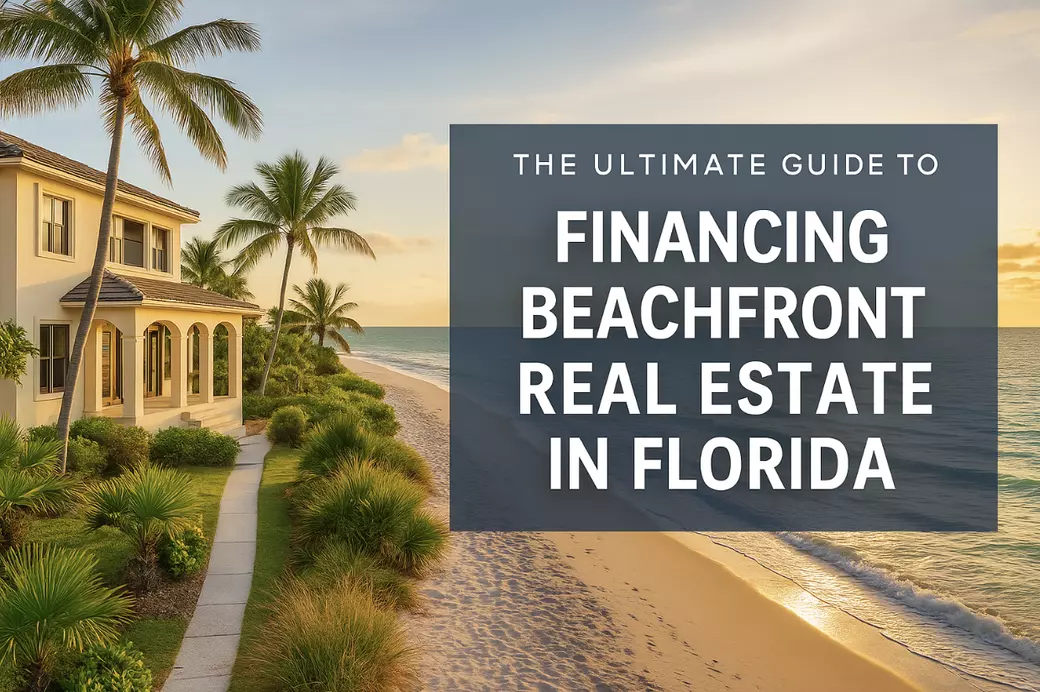

The Ultimate Guide to Financing Beachfront Real Estate in Florida

Beachfront real estate in Florida offers an unmatched lifestyle and strong investment potential, making it one of the most desirable property types in the U.S. Whether you're buying a luxury estate, vacation home, or income-producing rental, securing financing for a coastal property requires specific planning and expertise. This guide walks you through everything you need to know to finance a beachfront property in Florida, especially in high-value markets like Sarasota, Naples, and Miami Beach.

Understanding Your Financing Options

Many beachfront homes exceed conventional price limits, especially in Florida’s most sought-after areas. It’s important to understand the types of financing available based on property use, price point, and loan structure.

Conventional Loans

Conventional mortgages are ideal for primary residences or second homes priced under the conforming loan limit. These loans typically offer competitive interest rates for qualified borrowers with strong credit and financials.

Jumbo Loans

For luxury beachfront homes exceeding standard loan limits, a jumbo mortgage will be necessary. Jumbo loans allow for higher loan amounts but require:

- Higher credit scores

- Larger down payments (20–30%)

- Strong asset documentation

These are common for buyers in high-end coastal markets such as Casey Key, Longboat Key, or Palm Beach.

Second Home Loans

Designed for vacation homes used part-time by the owner, second home loans often feature better rates than investment loans. However, they require that the home not be rented for most of the year.

Portfolio Loans

For unique or non-conforming properties (such as beachfront cottages or historic homes), some lenders offer portfolio loans. These loans are held in-house and offer more flexibility on credit standards and income verification.

Investment Property Loans

If you plan to rent the home either short-term or long-term, it will be financed as an investment property. These loans typically involve:

- Higher interest rates

- Larger down payments

- Proof of rental income projections and reserves

What Lenders Evaluate for Beachfront Properties

In addition to your credit profile, lenders take a close look at the property itself. These are key evaluation points for coastal real estate financing:

- Credit Score: Most lenders require 700+ for jumbo or investment loans

- Debt-to-Income Ratio: Lower is better; ideally under 43%

- Down Payment: Minimum 20%, but often more for high-value properties

- Property Type: Condos, single-family homes, or multi-unit properties may have separate criteria

- Location: Flood zones, hurricane risk, and coastal erosion zones will impact underwriting

Unique Considerations for Florida Beachfront Financing

Buying in a coastal area like Florida comes with specific local and environmental concerns. These affect not just your loan terms, but your long-term costs and insurance requirements.

Insurance Requirements

Florida beachfront properties often require both:

- Flood Insurance (especially in FEMA-designated zones)

- Windstorm Insurance (common in hurricane-prone areas)

Lenders will factor these premiums into your overall loan eligibility and debt-to-income ratio.

HOA and Condo Fees

If you’re purchasing a condo or villa in a beachfront complex, lenders will evaluate:

- Monthly association dues

- The financial strength of the homeowners' association (HOA)

- Pending assessments or litigation

High dues or unstable HOAs can complicate financing approval.

Short-Term Rental Rules

If the property will be used as a rental, be aware of:

- Local ordinances on short-term rentals (city or county)

- HOA rules (some communities prohibit Airbnb or VRBO rentals)

These restrictions may influence loan type and revenue projections.

Tips to Secure the Best Financing Terms

Financing a beachfront property is more complex than financing a typical home. These strategies will help you prepare:

- Get Pre-Approved Early: Knowing your budget avoids wasted time and surprises

- Use a Coastal Lending Expert: Work with lenders who specialize in Florida waterfront real estate

- Work with a Local Real Estate Advisor: A knowledgeable agent can connect you with trusted lenders and off-market opportunities

- Budget Beyond the Mortgage: Include insurance, taxes, HOA fees, and maintenance costs

- Limit New Debt: Keep credit usage low before and during your application process

Ready to Purchase Your Florida Beachfront Property?

With the right financing strategy and a local real estate team behind you, buying a beachfront home in Florida can be a smart and rewarding investment. Whether you're looking for a primary residence with panoramic Gulf views, a luxury second home, or a high-return rental property, our team can help you navigate the process.

We provide:

- Customized property searches based on your financial goals

- Access to exclusive beachfront listings not publicly available

- Short-term rental projections and investment analysis

- Direct referrals to experienced coastal lenders and insurance experts

Contact Hunt Brothers Realty

Let’s simplify your journey to beachfront ownership. Whether you need pre-approval or want to explore available homes, we’re ready to help.

Hunt Brothers Realty46 N Washington Blvd Ste #3

Sarasota, Florida 34236

Phone: (941) 388-7017

Email: info@huntbrothersrealty.com

Categories

- All Blogs 633

- Buying Myths 6

- Down Payments 3

- Equity 1

- First Time Homebuyers 39

- Florida Real Estate 30

- For Buyers 57

- For Sellers 47

- Foreclosures 1

- Homeownership 22

- Housing Market Updates 27

- Infographics 6

- Interest Rates 6

- local market updates 4

- Millennials 2

- Mortgage 2

- Mortgage News 2

- Mortgage Rates 2

- Move Up Buyers 4

- Move-Up Buyers 7

- New Construction 1

- Pricing 10

- secondary homes 12

- Selling Myths 3

- Vacation Homes 27

Recent Posts