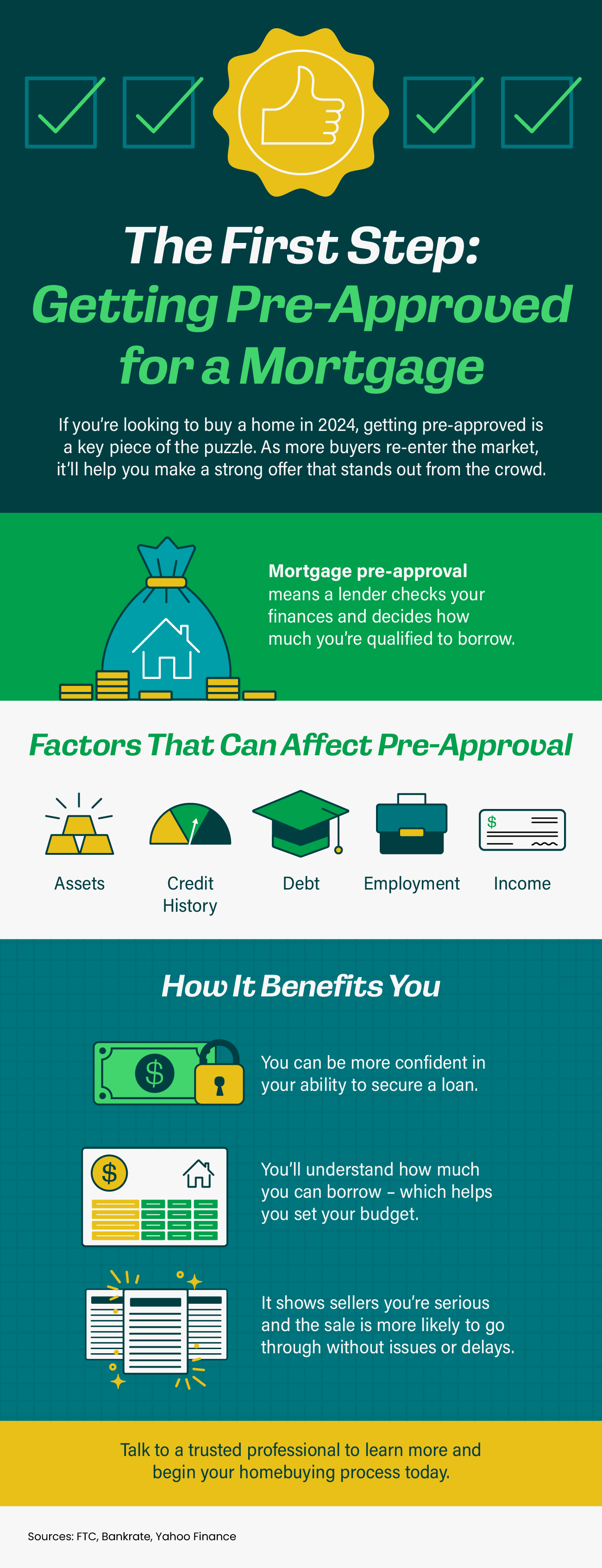

The First Step: Getting Pre-Approved for a Mortgage [INFOGRAPHIC]

Some Highlights

- If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow.

- As more buyers re-enter the market, it’ll help you make a strong offer that stands out from the crowd.

- Talk to a trusted professional to learn more and begin your homebuying process today.

Categories

- All Blogs 660

- Buying Myths 6

- Down Payments 5

- Equity 1

- First Time Homebuyers 50

- Florida Real Estate 41

- For Buyers 68

- For Sellers 58

- Foreclosures 1

- Homeownership 28

- Housing Market Updates 29

- Infographics 6

- Interest Rates 6

- local market updates 6

- Millennials 2

- Mortgage 2

- Mortgage News 2

- Mortgage Rates 2

- Move Up Buyers 4

- Move-Up Buyers 7

- New Construction 1

- Pricing 10

- secondary homes 18

- Selling Myths 3

- Vacation Homes 38

Recent Posts

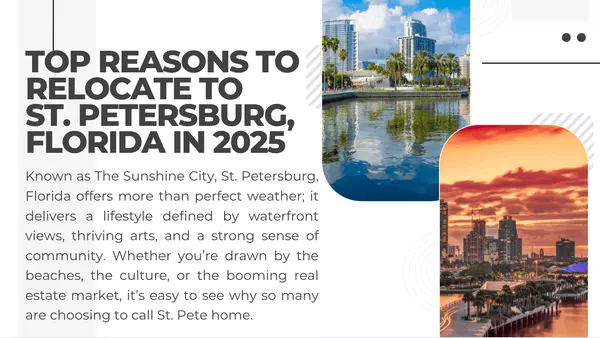

Top Reasons to Relocate to St. Petersburg, Florida in 2025

How To Make Sure Your Sale Crosses the Finish Line

Sarasota Fall Events: A Boost for Your Home’s Value

Thought the Market Passed You By? Think Again.

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

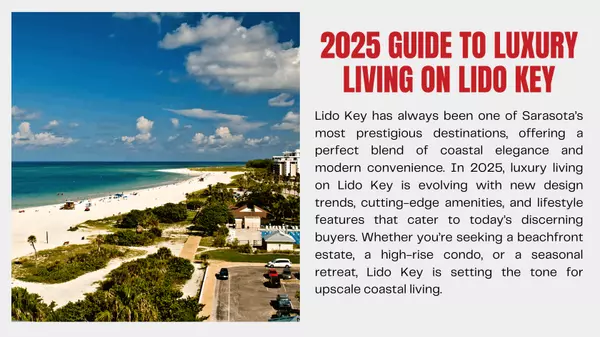

2025 Guide to Luxury Living on Lido Key

Why Some Homes Sell Quickly – and Others Don’t Sell at All

Proven Ways to Sell Your Venice Home Fast This Fall

The Reason Homes Feel Like They Cost So Much (It’s Not What You Think)

Planning To Sell in 2026? Start the Prep Now