How VA Loans Can Help You Buy a Home

For over 80 years, Veterans Affairs (VA) home loans have helped millions of veterans buy their own homes. If you or someone you know has served in the military, it's important to learn about this program and its benefits.

Here are some key things to know about VA loans before buying a home.

Top Benefits of VA Home Loans

VA home loans make it easier for veterans to buy a home, and they're a great perk for those who qualify. According to the Department of Veteran Affairs, some benefits include:

- Options for No Down Payment: Qualified borrowers can often purchase a home with no down payment. That’s a huge weight lifted when you’re trying to save for a home. The Associated Press says:

“. . . about 90% of VA loans are used to purchase a home with no money down.”

- Don’t Require Private Mortgage Insurance (PMI): Many other loans with down payments under 20% require PMI. VA loans do not, which means veterans can save on their monthly housing costs.

- Limited Closing Costs: There are limits on the types of closing costs you pay when you qualify for a VA home loan. So, more money stays in your pocket when it’s time to seal the deal.

An article from Veterans United sums up how remarkable this loan can be:

“For the vast majority of military borrowers, VA loans represent the most powerful lending program on the market. These flexible, $0-down payment mortgages have helped more than 24 million service members become homeowners since 1944.”

Bottom Line

Owning a home is the American Dream. Veterans give a lot to protect our country, and one way to honor them is by making sure they know about VA home loans.

Categories

- All Blogs 660

- Buying Myths 6

- Down Payments 5

- Equity 1

- First Time Homebuyers 50

- Florida Real Estate 41

- For Buyers 68

- For Sellers 58

- Foreclosures 1

- Homeownership 28

- Housing Market Updates 29

- Infographics 6

- Interest Rates 6

- local market updates 6

- Millennials 2

- Mortgage 2

- Mortgage News 2

- Mortgage Rates 2

- Move Up Buyers 4

- Move-Up Buyers 7

- New Construction 1

- Pricing 10

- secondary homes 18

- Selling Myths 3

- Vacation Homes 38

Recent Posts

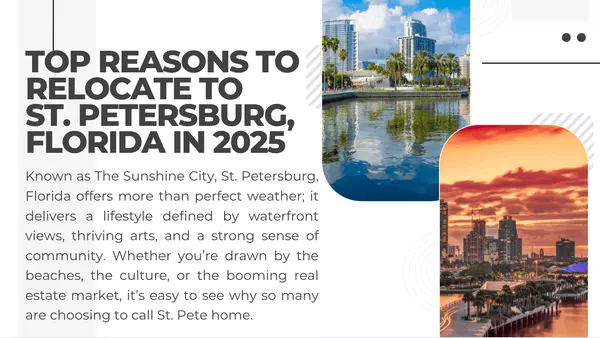

Top Reasons to Relocate to St. Petersburg, Florida in 2025

How To Make Sure Your Sale Crosses the Finish Line

Sarasota Fall Events: A Boost for Your Home’s Value

Thought the Market Passed You By? Think Again.

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

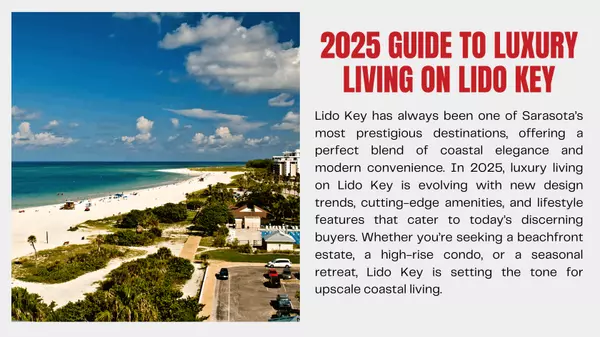

2025 Guide to Luxury Living on Lido Key

Why Some Homes Sell Quickly – and Others Don’t Sell at All

Proven Ways to Sell Your Venice Home Fast This Fall

The Reason Homes Feel Like They Cost So Much (It’s Not What You Think)

Planning To Sell in 2026? Start the Prep Now