Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC]

Some Highlights

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, connect with a local real estate agent for a Professional Equity Assessment Report.

Categories

- All Blogs 661

- Buying Myths 6

- Down Payments 5

- Equity 1

- First Time Homebuyers 50

- Florida Real Estate 41

- For Buyers 68

- For Sellers 58

- Foreclosures 1

- Homeownership 28

- Housing Market Updates 29

- Infographics 6

- Interest Rates 6

- local market updates 6

- Millennials 2

- Mortgage 2

- Mortgage News 2

- Mortgage Rates 2

- Move Up Buyers 4

- Move-Up Buyers 7

- New Construction 1

- Pricing 10

- secondary homes 18

- Selling Myths 3

- Vacation Homes 38

Recent Posts

Why Your Home Equity Still Puts You Way Ahead

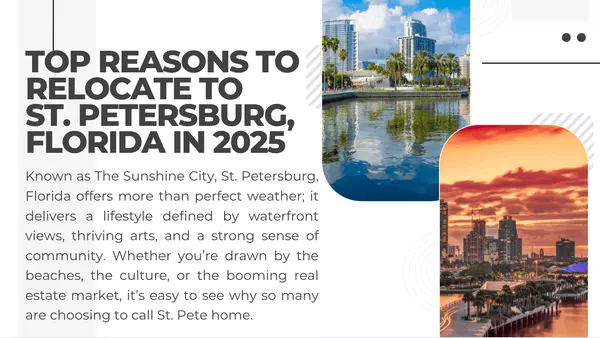

Top Reasons to Relocate to St. Petersburg, Florida in 2025

How To Make Sure Your Sale Crosses the Finish Line

Sarasota Fall Events: A Boost for Your Home’s Value

Thought the Market Passed You By? Think Again.

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

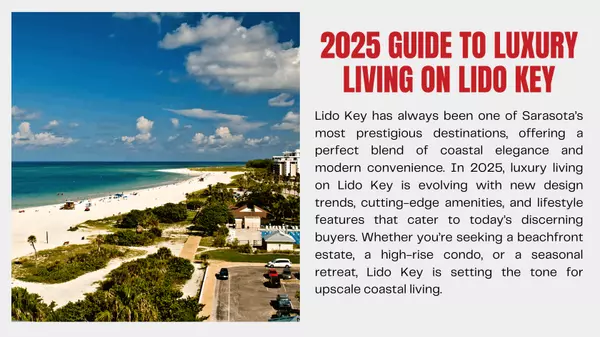

2025 Guide to Luxury Living on Lido Key

Why Some Homes Sell Quickly – and Others Don’t Sell at All

Proven Ways to Sell Your Venice Home Fast This Fall

The Reason Homes Feel Like They Cost So Much (It’s Not What You Think)